When it comes to making a budget that you can actually stick to, there is so much more to account for than transactions. Today we’re hearing from Hannah Brencher, writer, speaker, and budgeting pro, on how she paid off over $50k of student loans in one year, shifting our money mindset, and creating goals with intention.

In short, you do a lot! Can you share a bit about what ties together your writing, coaching, speaking, workbooks, and more?

I do a lot but I see a bunch of common threads in everything I do. I am passionate about the power of words (whether written or spoken), I am in love with the concept of discipline, and I am dedicated to helping others live better lives through the power of discipline. I like to think my work flows through those mediums. Trust me, I never thought I would be producing studies or budgeting sheets, but I’ve experienced so much joy in helping others become more disciplined and live a freer life.

How did finances and budgeting become a focus of what you want to empower others in?

I would have laughed in your face if you told me a few years ago that the first product I’d ever create for my shop would be budget sheets.

This whole “journey” (I guess it’s a journey?) began when I moved to Atlanta in 2014. It was my first time really flying solo with all my expenses: rent, car payments, health insurance, cell phones, and student loans. I had over $57,000 in student loan debt and I was always afraid that debt would keep me from living a beautiful life. I allowed that fear to rob me of a lot of things. I started with simple budget sheets that ended up helping a lot of people.

In January 2016, I decided to get really disciplined with killing my debt, wanting to get rid of most of it before my December wedding. I personally didn’t want to walk into marriage with a ton of debt. I wanted to tackle it and be proud of the progress I’d made. So I began saving and budgeting furiously and I killed all my student loan debt before December 31, 2016. This plan wouldn’t work for everyone, but I made this my biggest priority and I am so thankful I did. Since then, I’ve been addicted to finances!

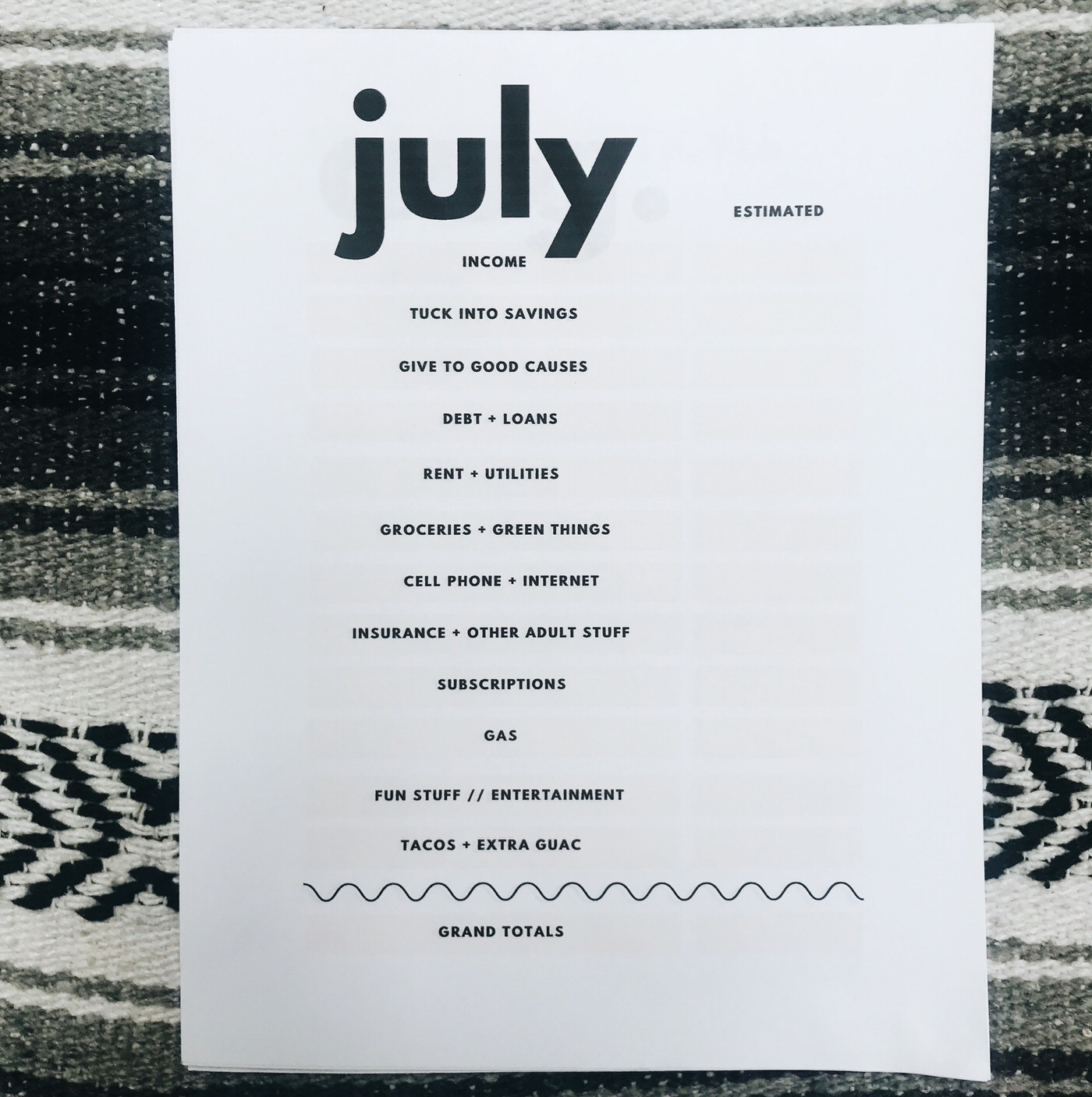

Tell us about your “no ruffles, no frills” budget sheets that you created! What is the intention behind the way you designed them to be used?

I honestly created those sheets for myself. I wanted a budget tool that wasn’t an app (I’m a pen and paper kind of girl), was easy to figure out, had a minimal look and feel to it, and saved room for tacos. I wanted someone to break budgeting down for me in a way that felt approachable and easy. I guess I did that for myself in a lot of ways.

These sheets aren’t for the spreadsheet wizard or the person who needs all the fancy finance gadgets. I created these sheets for people who love inspiration and also want to be smart with their money.

What are three key essentials to know when creating a budget that works?

-

Be realistic. If this is your first time budgeting then don’t overhaul everything dramatically. Be real with how much you spend in each area and budget accordingly.

-

Nix the credit cards while killing your debt. I never allow myself to spend more than I have. I use one credit card to accrue miles but I never spend money I don’t have. During my time of killing debt, I didn’t use credit cards at all and it made all the difference. A standard debit card will work.

-

I absolutely love using the app Qapital for saving money on the fly. It has changed my life and has helped me save for some of the biggest things in my life: killing debt, anniversary trips, Christmas shopping, tithing to my church, etc.

How about the three biggest pitfalls of a budget that doesn’t work?

-

It won’t work if you aren’t willing to be a little strict with yourself. I think you have to be willing to cut some stuff out (especially if you want to save).

-

It won’t work if you can’t be honest with all the areas where you’re spending money. A budget can’t account for 70% of what you spend. You have to go through your banking statements and really get honest.

-

I recommend budgeting every week. Keep checking in. The biggest mistake I used to make is not checking in with my budget until the end of the month. You have to keep tabs on it. It’s not going to be perfect month one, but you can improve daily, weekly, and monthly!

How has developing a healthy relationship with finances impacted your own life?

I can’t explain how amazing it feels to be debt-free! It really is freeing and makes the biggest difference. I think women have a tough time talking about money and I just want to scream, “LET’S TALK ABOUT IT! LET’S NOT BE AFRAID OF IT!!” The more money I make, the more generous I get to be.

Money is something you steward, not just something you spend.

Shifting my mindset towards money has made all the difference.

So much of what you do, from the books you write to the creative brainstorming coaching sessions you host, is built on a foundation of bringing intention - to others, to our goals, to our everyday life. What are some practical things you do, or teach, to remain focused on your intentions throughout the week?

I believe in making monthly goals that revolve around the areas I care most about: faith, relationships, finances, career, and health. I put my health first so that I can better take care of other people and thrive in my job.

I make sure my to-do list is an even balance of projects, plans, and people. I don’t want a week full of only projects or only plans. I need a good balance and so I try to break that down.

In your new book, Come Matter Here, you share some raw stories about struggles you have faced in your life. How have experiences from your past fueled the purpose behind the work that you now do?

I’ve known what it feels like to have work dominate your entire life. I’ve been that workaholic who believed all my value was tied to the work I did. I don’t think that anymore and I love getting to share with people that life is a balance of beautiful things. We just have to get better at balancing. I also love using my platform to inspire discipline, knowing you can change your life with a series of small steps. It won’t be instant or overnight but I promise, it’s worth it.

As we’re discussing in our September focus on Invest, often the most valuable things in our lives take a lot of inch-by-inch work. What advice would you give to women on how to keep moving toward their long term goals that feel far off?

Break the goal down into attainable steps. I mean, painfully attainable steps. Steps that seem so elementary because that’s where you start to see little victories. And little victories stack up to something bigger! So much of the time we set these massive goals and then feel defeated when we don’t reach them by a certain time. What if we broke them down? What if we really dug into the nitty gritty? We can all do hard things but it is a matter of doing it little-by-little on a daily basis.

Images courtesy of Hannah Brencher